· 4Q18 EPS of $0.52; Adjusted 4Q EPS up nearly 17% to $1.94

· Pricing and Mix Strategies Lift 4Q Revenue Quality

· U.S. Domestic Revenue up 6.3% on 4Q Yield Growth

· International 4Q Achieves Record Profits; Margin Rises above 20%

· Supply Chain & Freight Revenue Rises, driven by Forwarding and Logistics

· 2018 Full-year Cash from Operations was $12.7B

· Free Cash Flow in 2018 topped $6B, Exceeding Expectations

· 2019 Total Adjusted Operating Profit Growth* in the Low-teens with all Segments up Double-digits

· Announces Full-Year 2019 Adjusted EPS Guidance* Range of $7.45 to $7.75

ATLANTA – UPS (NYSE:UPS) today announced fourth-quarter 2018 earnings highlighted by high-quality revenue initiatives that are producing positive, sustainable benefits.

“We achieved our 2018 adjusted earnings-per-share goal by successfully executing Transformation investments and initiatives that lifted revenue quality and improved efficiency,” said David Abney, UPS chairman and CEO. “Our diverse portfolio, global footprint and flexible network position UPS for profitable growth in 2019 and beyond.”

| Consolidated

Results |

4Q 2018 |

Adjusted 4Q 2018 |

4Q 2017 |

Adjusted 4Q 2017 |

| Revenue |

$19,848 M |

$18,975 M |

||

| Net Income |

$453 M |

$1,690 M |

$1,096 M |

$1,445 M |

| Diluted Earnings Per Share |

$0.52 |

$1.94 |

$1.26 |

$1.66 |

Fourth-quarter 2018 GAAP results include a mark-to-market (MTM) non-cash, after-tax pension charge of $1.237 billion, which represents an after-tax charge of $1.42 per diluted share. In the prior-year period, the company’s GAAP results included $0.40 per diluted share related to mark-to-market pension charges and benefits from the Tax Cuts and Jobs Act.

For the total company in 4Q 2018:

· Revenue increased 4.6%; currency-neutral revenue was up 5.2%.

· Average revenue yield expanded 4.1%, with gains in all products.

· Achieved record shipments and exceptional on-time service during the peak holiday season.

* Information on non-GAAP financial measures is attached to this press release. The Company provides guidance on an adjusted (non-GAAP) basis because it is not possible to provide the most comparable GAAP measure. See “Outlook.”

U.S. Domestic Segment

The segment benefited from UPS’s Transformation initiatives, new network capabilities and higher-quality revenue during the period. The U.S. Domestic segment delivered more than 21 million packages, on average, per day with strong revenue yields and record on-time performance. Shipment growth was balanced, as business-to-business and business-to-consumer packages grew in the quarter. As anticipated, operating profit was reduced by planned pension expense, start-up costs for several large facilities, and one less operating day than in the prior year’s fourth quarter.

|

4Q 2018 |

4Q 2017 |

|

| Revenue |

$12,575 M |

$11,833 M |

| Operating profit |

$999 M |

$1,087M |

For the U.S. Domestic segment in 4Q 2018:

· Revenue increased $742 million or 6.3% over 4Q 2017, with growth across all products.

· Premium Next Day Air revenue grew more than 10%, with volume growth of 7.8% as customers selected faster delivery options.

· Revenue per piece increased 4.8% on expanded base rates and positive product and customer mix.

· The company successfully opened 14 major facilities in the U.S. during the quarter, providing higher efficiency and record on-time deliveries. For the full year, UPS opened 22 new facilities worldwide.

International Segment

“Our International segment produced record results highlighted by double-digit profitability in Europe,” said Abney. “Our broad portfolio, diverse revenue base and flexible network help buffer the impacts of global economic softening. These strengths also position UPS to help customers navigate the current complexities of global trade.”

|

4Q 2018 |

4Q 2017 |

|

| Revenue |

$3,829 M |

$3,721M |

| Operating profit |

$781 M |

$735 M |

For the International segment in 4Q 2018:

· Revenue expanded 2.9% with growth across all regions; currency-neutral revenue up 5.4%.

· Revenue per piece increased 1.7%; currency-neutral revenue per piece grew 4.2%, with international domestic products up 7.8% and export products up 3.6%.

· Operating profit grew 6.3%; adjusted currency-neutral operating profit increased 9.8% to $807 million, driven by growth, revenue yields and disciplined cost control.

· Operating margin expanded 60 basis points** (bps) to 20.4% on a reported basis and 80 bps to 20.6% on a currency-neutral basis, demonstrating improved operating leverage.

* Information on non-GAAP financial measures is attached to this press release.

** One basis point equals one-hundredth of a percentage point.

Supply Chain and Freight Segment

The Supply Chain and Freight business remains strong. Fourth quarter segment profitability was reduced by about $60 million as a result of the UPS Freight contract ratification process. Profitability for the other business units was positive, led by gains in Forwarding. Revenue-quality improvements and a disciplined focus on cost containment further contributed to the positive results.

|

4Q 2018 |

4Q 2017 |

|

| Revenue |

$3,444 M |

$3,421 M |

| Operating profit |

$224 M |

$241 M |

For the Supply Chain and Freight segment in 4Q 2018:

· The business units demonstrated continued growth as the result of greater alignment with small and medium-sized customers.

· Coyote, brokerage and international air and ocean freight made significant contributions to operating profit within Forwarding, demonstrating value to customers across the world.

· Logistics revenue increased almost 7% from growth in the Healthcare, Aerospace, Retail and Manufacturing sectors.

· UPS Freight increased revenue per LTL (less-than-truckload) hundredweight by 6.9%, with its continued focus on revenue quality.

Full-year 2018 Consolidated Results

· Total revenue increased 7.9% to $71.9 billion on shipment growth; revenue-yield expansion of 4.3% surpassed 2017 yield by 200 basis points.

· Full-year 2018 diluted EPS totaled $5.51; adjusted diluted EPS was $7.24.

· Adjusted diluted EPS excludes the impact of the MTM pension charge and Transformation costs.

· Paid dividends of $3.2 billion, an increase of 10% per share over the prior year.

· Repurchased 8.9 million shares for approximately $1 billion.

Outlook

The company provides guidance on an adjusted (non-GAAP) basis because it is not possible to predict or provide a reconciliation reflecting the impact of future pension mark-to-market adjustments or other unanticipated events, which would be included in reported (GAAP) results and could be material.

“UPS executed very well during the quarter in a challenging environment,” said Richard Peretz, UPS chief financial officer. “In 2019, we plan to generate substantial increases in operating profit growth in all three business units.”

· UPS expects total adjusted operating profit growth in the low-teens with all segments up double-digits.

· Adjusted, diluted earnings per share to be in a range of $7.45 to $7.75, which includes pension financing costs headwinds of about $325 million.

· The 2019 effective tax rate should be between 23 and 24 percent.

· Capital expenditures are planned between 8.5% and 10% of 2019 consolidated revenue.

· Transformation charges are excluded from guidance.

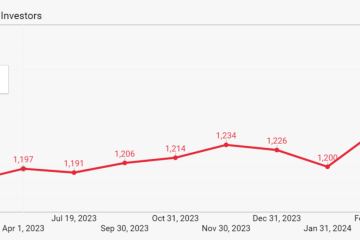

Conference Call Information

UPS CEO David Abney and CFO Richard Peretz will discuss fourth-quarter results with investors and analysts during a conference call at 8:30 a.m. ET, January 31, 2019. That call will be open to others through a live Webcast. To access the call, go to www.investors.ups.com and click on “Earnings Webcast.” Additional financial information is included in the detailed financial schedules being posted on www.investors.ups.com under “Financials” and as filed with the SEC as an exhibit to our Current Report on Form 8-K.